Square, Inc. (SQ) - Investment Thesis

Company overview

For those not familiar with Square’s business, I highly recommend reading their most recent Investor Presentation before diving into this investment thesis as this will build upon having an understanding of the current business.

2020 Investment Catalysts

1. COVID-19 has accelerated transition of offline commerce

to modern Point of Sale (POS) systems such as Square

It’s estimated that over 7.5 million small businesses are at risk of closure due to COVID-19. Undoubtedly many of them are Square

merchants that also have Square loans, which will negatively impact Square’s

transaction volume and loan defaults. This is well-known in the market and

likely priced into Square’s share price. The positive catalyst for Square is that

it’s the most popular POS for offline SMB commerce. The tremendous amount of

SMB turnover will increase share’s market share as businesses that close down

that were using legacy POS systems and cash-based transactions will be replaced

by new business owners that are more likely to use Square. Assuming the maximum

7.5m businesses that close down due to COVID-19 are replaced by 14% of businesses

that use Square POS that’s ~1million new customers for Square POS. The number

of small businesses in the U.S. has been gradually growing but is relatively steady at 31 million total.

Square’s investor presentation uses the 2012 U.S. Census to calculate their

seller ecosystem TAM at 2020, which has artificially deflated their growth

opportunity by using outdated figures. [how many sellers does Square serve

today to show size of opportunity].

2. Approval to participate in the PPP Loan Program

Square and other financial technology companies such as

Intuit and PayPal smartly capitalized on the US Government’s PPP program, which

has provided a low-cost method of customer acquisition and will likely improve

existing customer unit economics due to a deepened relationship with Square.

For example, it’s my point of view that merchants that receive a PPP loan

through Square are more likely to then apply for a Square Capital loan after

the PPP loan has been forgiven/retired. Square’s ability to rapidly deploy

loans through their Capital program is likely the reason that they received

140k applications and were able to approve 76,000 SMB loans totaling

$802 million in government lending. (Source) Irrespective of the number of new vs. existing Square customers that

participated in this program, it can only be seen as a positive for Square and

a second stimulus plan that is expected in the coming weeks / months will be a further

catalyst for the Seller ecosystem.

3. Square is transitioning Cash App into a modern bank

Square does not have its US bank charter, so currently all

of their lending is through a third-party lender - Celtic Bank. Square has been

attempting to receive a US bank charter for at least two years, and was even

considering acquiring a small bank to buy their way into a banking license. (Source) Acquiring bank charters is an expensive but not uncommon way for tech companies

to receive a US bank charter as it’s the route that LendingClub went to achieve

their charter. The US government’s urgency to rapidly deploy the stimulus

program through as many lenders forced them to open up the loan process to

non-lenders such as Square, Intuit and PayPal that do not have a bank charter

but operate on behalf of FDIC-member banks to provide loans. Although the US

Government was not required to approve Square’s bank charter application as a

requirement of PPP participation, Square was approved for PPP lending on April

13, 2020 (Source) and their bank charter to launch Square Financial Services was approved only a few days later on April 18, 2020, after working on their bank charter for over two years. Square has stated that

they initially only plan to replace Celtic Bank’s current role of facilitating

small business lending and deposit accounts, however, I do see significant

opportunities for Square to capitalize on their lender status not only in the

Seller ecosystem where it currently operates, but to extend their banking

charter to the Cash App that currently does not have any banking activities

today. Square Capital’s advantage relative to traditional bank lending is that

Square Capital only lends directly via their POS and business management

software. This requires the borrower to provide Square with two sizeable

advantages over traditional lenders, 1) significantly more data points to make

lending decisions on everything from the financial profile of the business to the concentration of their customer base, 2) a real-time, continuous stream of

information relative to traditional lenders that typically only have access to

borrower information during the initial loan application and re-reviews of that

information, 3) increased protection against fraudulent information since

Square has the ability to audit the financial information themselves relative

to traditional lenders that are often relying on borrower provided statements

from third-party software and banking institutions, 4) Square automatically

facilitates the repayment of merchant loans through a “fixed percentage of

every card transaction a seller takes". (Source) This may seem like an obvious point that is already fully priced into Square’s

valuation, but I believe that these same advantages will translate nicely into

their Cash App ecosystem. Cash App users that have direct deposit, use the Cash

App debit card and maintain deposits and investments in Cash App provide a

similar competitive advantage for Cash App relative to traditional lenders that

only have a siloed view of the credit risk due to limited, point-in-time

information that they use to make lending decisions. Square Financial Services

is expected to launch in 2021 and will likely improve profitability due to

vertical integration of their banking business via the removal of Celtic Bank

that is currently compressing the Net Interest Margin (NIM) for Square Capital.

Discussion on the Credit Risk of Square Capital’s Loan

Portfolio

The largest risk to my Square investment thesis is the

credit risk of Square Capital due to the Black-Swan nature of the current

global macroeconomic environment that has been triggered by COVID-19. Their

reliance on US-based small businesses will have a material impact on the Seller

ecosystem because they have felt the impact of COVID-19 more than almost every

other business segment globally. However, their credit

exposure does appear to be lower than initial glance because instead of

originating the loan and maintaining the loan portfolio on their own balance

sheet, Square Capital sells its loan portfolio to third-parties so Square

Capital primarily acts as a loan originator. I was not able to find sufficient details to accurately forecast their credit losses for FY Q2 based on how COVID

has unfolded, but Square’s FY Q1 10-Q filing does provide a glimpse into how

they are accounting for the credit risk:, “Transaction and loan loss expenses

were $109 million in the first quarter of 2020, which was an increase of $77

million and $81 million compared to the fourth quarter of 2019 and first

quarter of 2019, respectively.” Initially, the 5x Q/Q growth is concerning,

however, they also state that “This included reserves of $79 million for transaction

losses and reserves of $22 million for outstanding Square Capital loans.”

On a dollar basis, these reserve estimates were approximately 4x higher than

the fourth quarter of 2019 for each of our Seller transaction and Square

Capital businesses...To a lesser extent, the increase was also driven by

continued growth of our Seller transaction revenue, Cash App platform, and

Square Capital originations during the quarter.” This helps clarify the risk profile for loan

loss reserves – it’s reassuring that only $22 million of the total $119 million

was from expected loan losses with my estimate of the remaining $87 million

split between $72 million from transaction losses due to COVID and $15 million

in standard reserves to account for growth of the core business.

FY Q2 earnings

may prove that their initial estimate to be wildly incorrect, but the economic

impact from COVID began to improve before the FY Q1 earnings call on May 6,

2020. Therefore, I do believe that these estimates are likely (and hopefully) accurately

maintained when FY Q2 earnings are released. Ideally, management would have

shared more details on their loan portfolio in the Q1 shareholder letter to

alleviate investor concerns. Based on recent financial statements, we do know

that Square sells most of its loan portfolio to third-party institutional

investors, but does keep part of the loan portfolio as principal, “our

exposure to loans that we sell to third parties is more limited, we expect

that the impact of COVID-19 on loan performance will increase risk loss for our

owned loan portfolio.” Diving into the numbers behind this

statement, Square listed $160 million in loans on their balance sheet at the

end of FY Q1 2020, which is flat Q/Q from FY Q4 2019. They also listed $556

million of Sale and Principal in merchant payments on their loan portfolio and

$574 million of in purchases of loans Rising defaults in Square Capital’s loan

originations will likely result in higher credit spreads to account for the

expected deterioration in their originations.

The US Government’s continual

financial support to both businesses and individual’s has removed much of the

“tail risk” from not only Square Capital’s loan portfolio, but also doubled the number of Cash App direct deposits

month-over-month. This provided an infusion of cash into Cash App via the CARES Act

that overlapped with the seasonally strong tax refund months that brings Square to its current $1.2bn in customer deposits.

|

| Source: Square FY Q1 2020 Shareholder Letter |

Recommendations to Management

1. Stop issuing convertible bonds

Management has completed two convertible bond

issuances in the past few years, which has been dilutive to shareholders as

both are now in-the-money. Given the record low-interest rates, my strong

recommendation to management is to stop issuing convertible debt and instead

issue traditional corporate debt. The only solace is that quarterly filings show that management is hedging out most of the dilution, but it's still costing them more than traditional, non-convertible debt issuances.

2. Increased investment in Square's digital commerce offering

The acquisition of Weebly bolstered Square’s

online store presence, and the recent acquisition of Stitch Labs to enable

omnichannel inventory management is another step in the right direction.

However, Square must continue to invest in online shopping as a defensive move

against Shopify that has continued to build out their offline commerce

capabilities. Offline commerce is a shrinking market opportunity as more commerce transitions online. My recommendation to management is to break out the Seller ecosystem payment volume between offline and online commerce with aggressive targets to increase online commerce as a percentage of total volume.

-

3. Continue investing in banking products and stop building investment features for Cash App

Square should not continue to invest in Square

Investing, where Cash App users can purchase Bitcoin and equities such as Coca

Cola shares. The current platform is extremely simple, which is great for the

casual investor, but additional features to compete with Robin Hood, Fidelity

Investments, etc. will only be a distracting given that market is extremely

saturated and competitive. Square should instead focus on building out banking

products and facilitating the connection between both of their ecosystems –

Seller and Cash App. An example is Venmo’s recent expansion into business Venmo

accounts, where merchants can accept Venmo payments via QR codes. I have

personally seen more merchants adopting Venmo as a form of payment and Cash

App should focus on expanding into this category as well. Using the Cash App

Visa card is not as competitive due to the processing fees that Visa charges,

whereas transactions directly between Cash App accounts has zero processing

costs.

-

4. Accelerate the combination of the Seller and Cash App ecosystems to create a combined flywheel effect

Continuing on the last point, Square is uniquely

positioned to win against other FinTech and traditional payment processors

because of their dual ecosystems on both sides of the transaction – buyer and

seller. Square must better leverage this advantage by creating more incentives

for both sides to these ecosystems to transact with each other. Pushing online and offline merchants to accept direct Cash App payments by removing the Visa Cash App debit card from the payment loop creates a unique competitive advantage by letting Square pass through the reduced processing and card issuer costs to the buyer and seller. Square should employe a strategy similar to Venmo's, which is facilitating more direct merchant-to-consumer transactions through Cash App instead of pushing consumers to continue using their Cash App Visa debit card. Venmo's direct payment strategy removes the ~2% payment processing and bank card fees, so the 1.9% transaction cost that Venmo charges to merchants is close to 100% in gross profit. Square has shown early signs of understanding this competitive advantage by offering "Boosts" to create outsized spending rewards such as 10% cashback for purchases at certain Square merchants, but so far these have only been through the Visa debit card and not through direct Cash App transactions.

-

5. Create more trust in your app via FDIC and build additional security features

Square must mprove trust in the Cash App platform to attract larger deposits and primary

banking relationships, including improving the user interface away from the game-like . Mainstream consumers will continue to rely on

traditional banks for the bulk of their banking activities because of the

implicit trust and safety that resides with these legacy institutions. Although

Square’s userbase is exploding, they must continue to invest in safety and

security to grow average deposits per customer and to convert consumers to use

Square for their primary banking activities.

-

6. Hire a fulltime CEO

This recommendation will be controversial, but I do

believe that Square should consider an improved corporate governance structure by reducing Jack Dorsey's role as Chairman and CEO if he will not devote100% of his time to leading Square. As most of you know, he is also the CEO role at Twitter and has recently voiced interest in working remotely long-term from Africa. Elon Musk has done a phenomenal job as CEO at both Tesla and SpaceX by creating significant shareholder value in his dual role. Jack has done similarly well for Square with over 10x share price appreciation since its IPO. However, Twitter's share price has fallen since its IPO 7 years ago and would be better served with a new, full-time CEO that can focus on increasing monetization of the platform and addressing the current regulatory risk that is facing social media platforms. However, the Board and shareholders should insist that Jack devote 100% of his time to Square and live domestically in the U.S. Otherwise, Square would be better served with Jack as Chairman and Chief Product Officer, where Jack would relinquish the CEO title to someone else to execute on his vision.

7. Evaluate connecting with PayPal/Venmo for financial

transactions – there is enough white space for them to be better together

There are technological challenges of this

recommendation that I do want to acknowledge upfront, but Cash App and Venmo could accelerate their

growth by enabling cross-platform transactions. This is a blue ocean opportunity where they are uniquely positioned to win the market together. I do not see a winner-take-all scenario given that Square and PayPal are currently less than 5% of the total market share. This

would allow for Venmo merchants to accept Cash App payments and vice a versa,

which would significantly increase merchant

acceptance rates across both ecosystems. Two-sided marketplaces are extremely difficult to build velocity, but the combination of both ecosystems, potentially via a centralized ledger, would benefit both companies and create a new payment network. The top 10 US Banks have a market

capitalization of ~$1.6 trillion at the time of this writing, whereas Square

and PayPal are ~$250 billion in combined market cap, or less than the size of each of the 3

largest US banks. There is a real opportunity for both companies to create a duopoly by working together because the incumbent financial institutions (JP Morgan, Visa, etc.) will be extremely difficult to displace.

Profitability

Many traditional and value-based investors will question the

margin profile of Square’s business that turned its first full-year net income

profit in FY 2019, but has been profitable on an adjusted EBITDA basis since FY

2016. It’s important to note that Square is not a traditional financial

services company, but a growth, recurring revenue technology business. Applying

this valuation approach requires evaluating the individual customer cohorts to understand

the viability of their path to +20% EBITDA margins.

Seller Ecosystem

Their Seller ecosystem’s 5:1 ratio of Customer Acquisition

Cost to Customer Lifetime Value (CAC/LTV) is a very positive tailwind for this

business given the difficulty traditionally poor unit economics for SMB

businesses due to high churn. As long as this ratio is still strong for more

recent customer cohorts, my recommendation is for Square management to more

aggressively invest in GTM spending for their seller ecosystem irrespective of

the impact on near-term profitability.

Turning to its faster-growing, Cash App Ecosystem, the payback period is even faster with a $1.4m investment resulting in $7.7 million

in cumulative gross profits that results in a 5.5x LTV / CAC ratio in less than

two and a half years – or twice to reach 5x as it does for the Seller ecosystem.

This is likely due to the virality of the product that benefits from having a

strong network effect and moat of a two-sided marketplace that is not evidence

in their Seller ecosystem. Similar to my recommendation for their Seller

ecosystem, management must continue to aggressively invest in GTM and customer

acquisition for the Cash App.

Cash App – Square’s Growth Engine

Cash App's unit economics that were explored in the previous section outline the value of each new user for the banking app, but it can be difficult to measure the customer journey funnel from awareness, app download, active user, all the way through transacting user. Google Trends search data provides directional insights into the relative strength of Cash App vs. Venmo. You can see that Venmo was the clear market leader in 2017. Starting in the Southwest U.S., Cash App began to overtake Square and has since spread to a leadership position in most of the states. Due to the strong network effect of P2P networks such as Venmo, it's difficult to imagine how they squandered such a leadership position and have fallen behind Cash App. My viewpoint is Cash App has been focused on building a more modern version of a consumer bank with debit card, spending rewards, direct deposit and simplified stock market and Bitcoin investing functionality. These features have resonated with underbanked consumers and banked consumers that are looking for a more modern banking experience and have always been in addition to the P2P payment network that Venmo offers. Cash App's homepage tagline further supports this notion, "Send, spend, save, and invest. No bank necessary." Venmo's homepage tagline of , "Use Venmo To Pay Online And Share Or Split Your Purchases" outlines its mission to be a social payment app to facilitate P2P transactions. Venmo has typically trailed Square in adding new functionality such as their recent announcement to extend into Bitcoin investing two years after Cash App launched the feature.

Even in California, where Venmo is still the market leader, Google Trends data over the past 4 years shows that Cash App has finally caught Venmo with most of the gap closing within the past year:

Zooming out and comparing the two apps on a global view, data over the past 12 months shows Cash App is ahead of Venmo in every country besides Canada (this analysis excludes low volume countries). I could not find any data to support that Cash App is officially available anywhere beyond the U.S. and the U.K, however, the below indicates that it does appear that the app is being used in other countries. Cash App's recent market expansion into the UK is an early indicator of its growth plans. The app now lets those in the UK and U.S. send money to each other where the currency is converted during the transaction without any foreign exchange fees. Jack Dorsey's commitment to Africa and other underbanked countries provides fertile ground for Square to grow internationally into new markets.

The largest U.S. banks created Zelle to enable P2P money transfers across banking institutions, which serves as a competitor to Cash App, Venmo and PayPal in many ways. Zelle is typically embedded within traditional online bank accounts such as Wells Fargo's banking website, so comparing Zelle search and mobile app analytics to Cash App and Venmo is misleading. Zelle touts an impressive 800+ participating banks, $187 billion in 2019 network volume, and 743 million in 2019 transactions. Cash App does not provide that level of detail, so an accurate size comparison cannot be made between the ecosystems. As a proxy, I am using Sensor Tower's mobile app download data, which provides a fair comparison between Cash App and Venmo given that they are only available to use via their respective mobile apps. Whereas Zelle and PayPal are available via alternative means (desktop, third-party apps, etc.).

You can see that the above app download data from SensorTower data generally correlates to the below Google Trends search data for Venmo, Cash App and Zelle. This confirms that Cash App passed Venmo around November 2019.

Financials Profile

Square's two ecosystems are completely independent from a financial standpoint, but Square has yet to fully break out both ecosystems into their own financial statements. Square's financials are currently outlined by business model (Transaction-based, subscription, etc.), so that's the view that I have presented below with my estimates applied to these financials and Square's high-level guidance to arrive at more detailed financials for Cash App and the Seller ecosystem. Square only provides a high-level financial overview of Seller and Cash App in its quarterly shareholder letter that accompanies the SEC filings. On the FY Q1 '20 earnings call, Square indicated that at some point in FY 2020 they will begin breaking out the financials of both ecosystems.

Cash App revenue is growing much faster than the Seller ecosystem, but much of the growth is attributed to Bitcoin that should be adjusted out of Cash App revenue to correctly evaluate the financial profile. Square agrees with this sentiment and states in their most recent shareholder letter, “We deduct bitcoin revenue because our role is to facilitate customers’ access to bitcoin. When customers buy bitcoin through Cash App, we only apply a small margin to the market cost of bitcoin, which tends to be volatile and outside our control. Therefore, we believe deducting bitcoin revenue better reflects the economic benefits as well as our performance from these transactions.“ In layman’s terms, Square’s revenue attributed to Bitcoin is the total amount of Bitcoin that is transacted on the Cash App. So if I buy 1 Bitcoin for $8,000 then Square recognizes $8,000 of revenue. The correct way to look at Square’s Bitcoin revenue is to use the gross margin from Bitcoin which was $14 million for the trailing year instead of the $757 million in Bitcoin transactions that Cash App facilitated that is counted as revenue on their financial statements.

Even after adjusting out Bitcoin revenue, Cash App had an impressive $222 million in quarterly revenue in FY Q1 2020 with 98% Y/Y revenue growth. Transaction-based and hardware revenue is primarily from the Seller ecosystem, and Subscription and Services and Bitcoin revenue is primarily from Cash App although there is overlap across Transaction-based and Subscription and services revenue.

Valuation Analysis

Valuation based on industry peers

Square's valuation is primarily driven by forward-looking revenue growth and gross margin. My initial valuation methodology was to evaluate Square's Enterprise Value / Forward Revenue against its closest industry peers: PayPal and Shopify. Square is currently trading at 9x Forward Revenue despite Wall Street's average estimate for ~40% forward-looking revenue growth, which is growing more than twice as fast as PayPal that is also trading at 9x Forward Revenue. Square's 40% gross margin relative to PayPal's 60% gross margin is weighing on its valuation. Adjusting out Bitcoin revenue from the gross margin model increases Square's overall gross margin by 10 points in FY Q1 to 50%, and is expected to continue growing to 54% by 2021. Square's much faster revenue growth and similar gross margin by the end of 2021 provides upside to my model that Square's EV / Forward Revenue multiple should expand by two-turns to 11x forward revenue by the end of this year. This is the case for my $172 price target, which is 42% upside to today's share price. The sensitivity analysis in the below table on the right side shows downside risk if Square were to slow/increase revenue growth and/or be re-rated on their trading multiple up or downwards. My estimated fair value range for Square's share price at the end of this year is $150 - $190 per share based on these assumptions.

Sum of Parts Valuation

Square's two ecosystems are so unique that it's worth valuing them independently to understand if the sum of the parts is worth more than the current valuation. Square's sparse financial data around the health of both products requires valuing them based on their total revenue instead of a more granular view that factors in different types of revenue. As discussed earlier, this analysis and the corresponding sum of parts valuation will become much more clear once Square begins breaking out the financials for both products during one of the three remaining quarterly earnings in 2020.

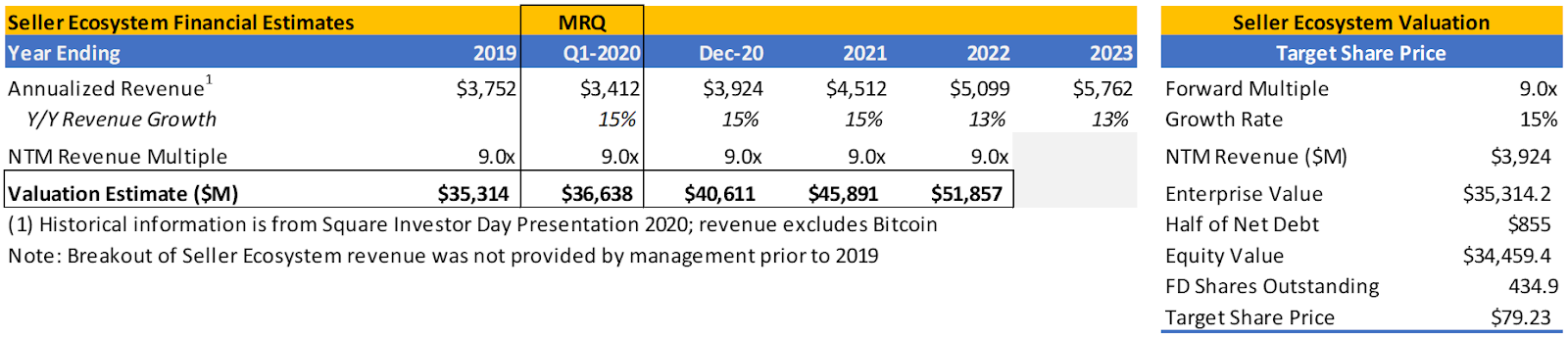

Starting with the Seller ecosystem, I've maintained a similar growth profile to its recent historicals around 15% through the forecast period. My valuation assumes PayPal's EV/NTM Revenue trading multiple of 9x given their similar revenue growth and margin profile. The below illustrative analysis arrives at a current valuation of ~$36 billion for the Seller ecosystem that grows to $52 billion in 2022 or about $80 per share.

Sensitizing this valuation arrives at a target range of $70 to $90 per share based on 8x - 10x trading multiple and 13 - 15% revenue growth. I've provided a broader 7x to 11x multiple and 11 to 19% growth to better understand the full range of potential outcomes:

Turning to Cash App, the revenue estimate requires a few key drivers and assumptions around forecasting # of acting transacting customers, monetization rate, and average revenue per user. Due to the faster revenue growth of Cash App, my analysis assumes a higher trading multiple of 20x akin to a high growth-startup and declining to 14x at the end of the forecast period as revenue growth decelerates. The valuation arrives at a target fair value for Cash App of $30 billion or $70 per share.

Sensitizing the key assumptions of average revenue per user and the forward trading multiple arrives at a valuation range of $58 to $90 per share.

Combining both sum of parts valuations arrives at a target share price of $180 with a sensitized base case through upside target valuation range of $152 to $210 per share.

Conclusion

Square's two ecosystems contrast each other - the legacy Seller ecosystem business that has started to reach a state of maturity, and the high-growth consumer banking app that is still in the early stages of its maturity lifecycle. As the financial profile of Cash App continues to grow relative to the size of Seller ecosystem, Square's overall revenue growth will begin accelerate leading to an expansion in trading multiples and increase in share price towards my target valuation of $180 per share by the end of 2020. However, I do foresee near-term share price volatility due to COVID's impact on the Seller ecosystem's transaction volume and corresponding credit risk on the loan portfolio.

--

Note: I own shares of Square, Inc. (SQ); all information in this post was sourced from publicly available information and is not intended to be investment advice. This information is educational in nature, please perform your own diligence before making any investment decisions.

Square's two ecosystems contrast each other - the legacy Seller ecosystem business that has started to reach a state of maturity, and the high-growth consumer banking app that is still in the early stages of its maturity lifecycle. As the financial profile of Cash App continues to grow relative to the size of Seller ecosystem, Square's overall revenue growth will begin accelerate leading to an expansion in trading multiples and increase in share price towards my target valuation of $180 per share by the end of 2020. However, I do foresee near-term share price volatility due to COVID's impact on the Seller ecosystem's transaction volume and corresponding credit risk on the loan portfolio.

--

Note: I own shares of Square, Inc. (SQ); all information in this post was sourced from publicly available information and is not intended to be investment advice. This information is educational in nature, please perform your own diligence before making any investment decisions.

Comments

Post a Comment